will long term capital gains tax change in 2021

Here are the numbers to keep in mind when it comes to long-term capital gain tax rates for the year 2022. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from.

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

By contrast with short-term capital gains people can pay a minimum of 10 and potentially as high as 37 in tax depending on their.

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

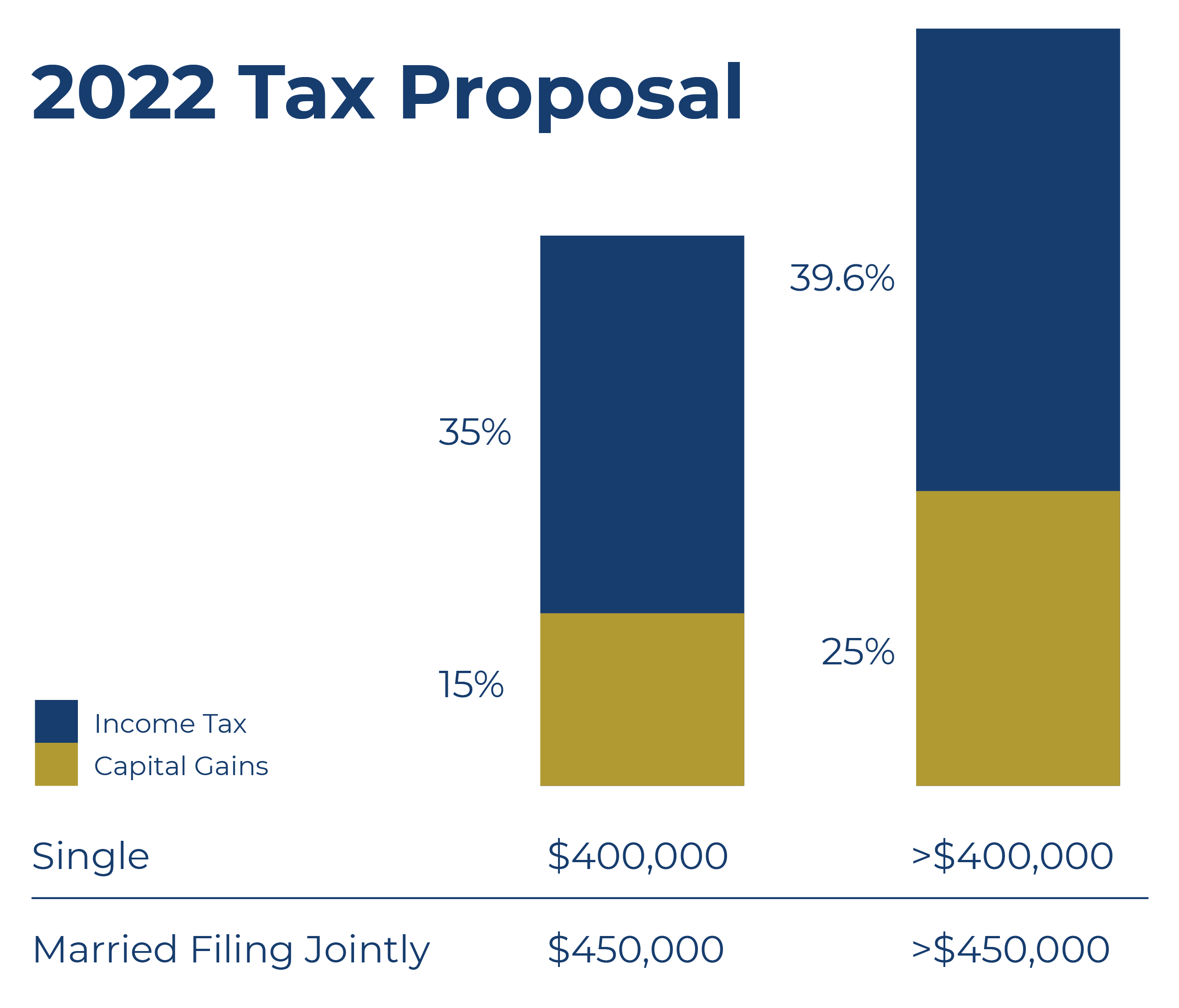

. This new capital gains tax bracket would apply only to individuals with adjusted gross income AGI in excess of 1 million. The 50 of the capital gain that is taxable less any offsetting capital losses gets added to your income and is taxed at your marginal tax rate based on your level of income and province of. 2021 US Capital Gains Tax Changes - Alpen Partners AG 1 week ago The current capital gain tax rate for wealthy investors is 20.

On April 28 2021 Joe Biden proposed to nearly double. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. 4 rows The effective date for this increase would be September 13 2021.

There are a few other exceptions where capital gains may be taxed at rates greater than 20. Tax Return for Seniors and capital gain or loss on. 2021-2022 Capital Gains Tax Rates.

So for example if you plan to sell stock that will produce 1 million in long-term capital gains and you have the flexibility to close the transaction in either 2021 or 2022 you. How to Calculate Canada Capital Gains Tax in 5 Steps. 2022 Capital Gains Tax Rates by State - SmartAsset.

Individual Income Tax Return or Form 1040-SR US. The taxable part of a gain from selling section 1202 qualified small business. Up to 41675 for singles up to 55800 for head of household up to.

At worst the IRS will take a 20 piece. 1 week ago Sep 15 2022 Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0. Long-term gains still get taxed at rates of 0 15 or 20.

2 days ago You may have to report compensation on line 1 of Form 1040 US. Additionally the proposal would. In other words if your long-term capital gains bring your taxable income 1 over the level for the 25-35 bracket only 1 will be taxed at 15 and the rest of your long-term.

Individuals with AGI under the 1M threshold will. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million. Long-term capital gains taxes apply when you sell an asset at a.

According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status.

What You Need To Know About Capital Gains Tax

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax What Is It When Do You Pay It

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

15 Capital Gains Tax Facts To Know Thinkadvisor

Biden Capital Gains Tax Rate Would Be Highest In Oecd

How The Potential Tax Changes Can Impact Your Investments Chase Com

How To Know If You Have To Pay Capital Gains Tax Experian

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Real Estate Capital Gains Tax Rates In 2021 2022

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

The Tax Impact Of The Long Term Capital Gains Bump Zone

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Short Term And Long Term Capital Gains Tax Rates By Income

American Families Plan Tax Proposal A I Financial Services

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube